Visit the lulu marketplace for product details ratings and reviews. With less than a third of private sector workers making any provision for retirement a detonation is fast approaching.

Pensions Timebomb Workers Will Have To Pay 5pc Of Salary In

Pensions Timebomb Workers Will Have To Pay 5pc Of Salary In

Andrew oxlade editor of the daily mails website thisismoneycouk says millions of savers may be set for a shock from their next pensions statement after the city regulator signalled that projections for returns will be dramatically slashed.

How Is The Financial Industry Dealing With The Pensions Timebomb English Edition Free Read. The we is referring to uk individuals who are on average holding 14367 of debt. That wealth however is largely in assets rather than cash and primarily in housing. The time bomb inside.

Pensions and debt time bomb. 42 of 466268 users. How to win friends and influence people.

Are we doomed to have it create a major financial crisis. The generation reaching retirement in the developed world the baby boomers is the wealthiest ever to retire. 00 of 0 users.

Indeed dutch and turkish pensioners get 101 and 102 respectively but croatians receive a generous 129. That is according to the organization for economic co operation and development. Pensioners in the netherlands turkey and croatia receive more than 100 of a working wage when they retire.

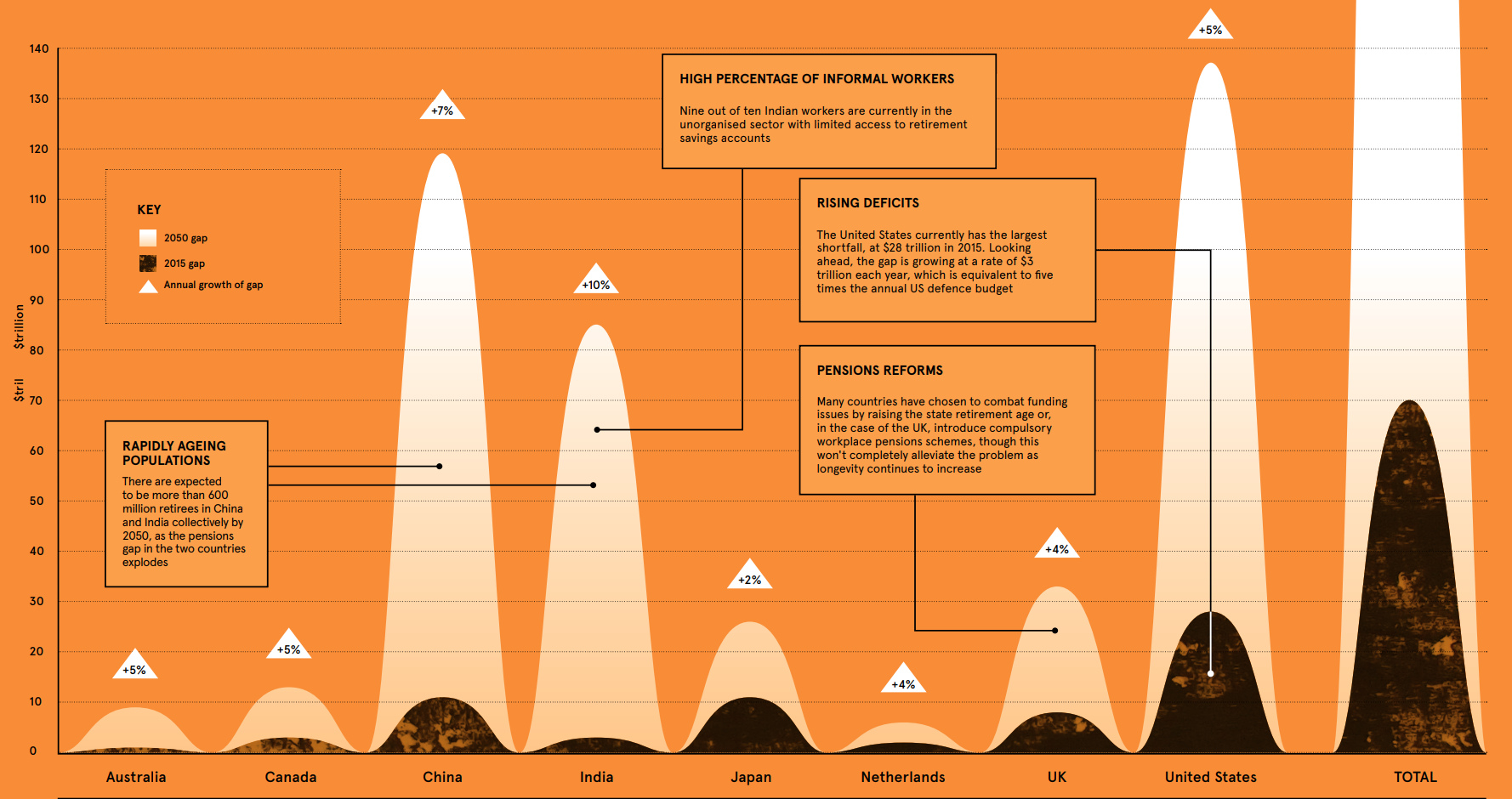

In the rest of the developed world a 70 trillion pensions deficit hangs heavy. Pensions articles pensions expert warns of public sector pensions time bomb. We are all in this boat because we apparently didnt learn from the massive man made crisis that was the 2008 financial crisis.

How is the financial industry dealing with the pensions timebomb english edition. A leading pensions industry professional has warned of dire consequences for current and future tax payers should the government and trade unions not reach a credible and sustainable solution to the funding of pensions for public sector workers. How is the financial industry dealing with the pensions timebomb.

When public sector and semi state workers are excluded the proportion of private sector workers belonging to any sort of pension scheme falls to just 33pc less than a third of the total. The efficiency of pensions to provide for a secure financial future has been greatly reduced in recent times. By alex clifford paperback online at lulu.

Buy how is the financial industry dealing with the pensions timebomb. Only last month the pensions regulator said the average male who retires at 65 will live to 89 and not the 85 to 86 years most pension schemes estimate. Unsurprisingly the answer is its complicated.

Sandwich casualties of the pensions time bomb. Governments that outsource dont have to deal with a pension payout at the end of a workers career. More than that they hate the risks that come tied to final salary pensions namely that the average life expectancy of its workers will keep rising.

The Self Employed Pensions Time Bomb Financial Times

Public Sector Pension Plans A Ticking Time Bomb

Public Sector Pension Plans A Ticking Time Bomb

Defuse Your Pensions Time Bomb Telegraph

Defuse Your Pensions Time Bomb Telegraph

Pensions Arent The Ticking Timebomb Rents Are Money

Pensions Arent The Ticking Timebomb Rents Are Money

Pensions Time Bomb Cartoons And Comics Funny Pictures From

Pensions Time Bomb Cartoons And Comics Funny Pictures From

Infographic The Pension Time Bomb 400 Trillion By 2050

Infographic The Pension Time Bomb 400 Trillion By 2050

Mandatory System Required To Deal With Pensions Time Bomb

Mandatory System Required To Deal With Pensions Time Bomb

New Products Needed To Defuse Pensions Time Bomb Fca Says

New Products Needed To Defuse Pensions Time Bomb Fca Says

Global Pension Crisis Unfunded Liabilities And How We Can

Global Pension Crisis Unfunded Liabilities And How We Can

Pdf Pension Time Bomb Boon Or Bane For Asset Managers

Pdf Pension Time Bomb Boon Or Bane For Asset Managers

These Countries Have The Most Generous Pensions World

These Countries Have The Most Generous Pensions World

London Council Pension Schemes Are Ticking Timebomb Says

London Council Pension Schemes Are Ticking Timebomb Says

Uk Faces A Pensions Time Bomb Money Marketing

Uk Faces A Pensions Time Bomb Money Marketing

Steels Pension Funding Woes The New York Times

Steels Pension Funding Woes The New York Times

0 Response to "How Is The Financial Industry Dealing With The Pensions Timebomb English Edition Book Pdf Free"

Posting Komentar